New Delhi, September 2025.

As India positions itself as a global hydrogen leader, the inaugural World Hydrogen India summit convenes policymakers, industry leaders, and investors to shape the country’s evolving hydrogen economy. Experts from S&P Global Commodity Insights highlighted how hydrogen’s role in global and Indian energy transitions will expand significantly, with India uniquely placed to emerge as a cost-competitive global supplier while deepening domestic adoption.

Shri Pralhad Venkatesh Joshi, Minister of New and Renewable Energy delivered a virtual keynote address on ‘India’s National Green Hydrogen Mission: Policy, Incentives, and the Road to 5 MMt by 2030’. Meanwhile, Dave Ernsberger, Co-President, S&P Global Commodity Insights hosted a fireside chat with Shri Hardeep Singh Puri, Minister of Petroleum and Natural Gas around the topic ‘Powering India’s Green Future with Hydrogen’.

India’s Strategic Play in Hydrogen

Pulkit Agarwal, Head of India Content, S&P Global Commodity Insights, said:“India’s emergence as a pivotal player in the global hydrogen economy is deeply intertwined with its broader energy and commodity market evolution. The National Green Hydrogen Mission, backed by over $2.4 billion in investment, targets production of 5 million metric tons annually by 2030, with ambitions to export more than half of this volume. This dual focus on domestic consumption and export readiness reflects a nuanced strategy: building internal resilience while positioning India as a cost-competitive supplier to global markets.”

He further noted hydrogen’s disruptive impact across India’s energy value chain, city gas, refineries, fertilizers, and renewables, while underlining pricing as a critical hurdle requiring sustained policy support and robust market mechanisms.

Global Growth Outlook and Hydrogen’s Rising Share

Abhay Singh, Senior Analyst, Quantitative Analysis, S&P Global Commodity Insights, said: “Globally, hydrogen demand could grow up to 3.5 times current levels by 2060 in our Renaissance scenario, rising from 1.7% of final energy demand today to potentially over 7%. India too is expected to see hydrogen’s share in final energy demand grow from 1.8% today to beyond 3% in the Renaissance scenario, with nearly 80% of production potentially from green hydrogen. This evolution underscores India’s balancing act, sustaining economic growth while driving decarbonization.”

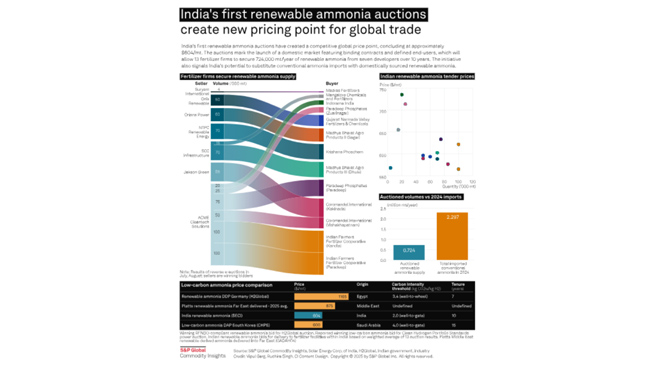

Hydrogen Trade and Cost Competitiveness

Gauri Jauhar, Executive Director, Energy Transitions & CleanTech Consulting, S&P Global Commodity Insights, highlighted: “India and China are emerging as the lowest-cost supply regions for electrolytic ammonia. India’s finalized Green Hydrogen Certification Scheme, which mandates emissions under 2 kg CO₂e/kg H₂ for funded projects, is a critical step in aligning with global standards. With larger electrolysis projects concentrated in India, China, the US, and Europe, India’s ability to scale up to 100–500 MW projects will be key to accelerating its hydrogen ecosystem.”

Hydrogen’s Role in Decarbonizing Shipping

Rahul Kapoor, Head of Shipping Analytical Research, S&P Global Commodity Insights, added: “India is prioritizing hydrogen and ammonia as alternative marine fuels to reduce shipping emissions and achieve net-zero goals. The government’s vision includes green ammonia bunkering facilities at one port by 2025 and all major ports by 2035, aligning maritime infrastructure with export ambitions. This positions India to participate actively in future clean fuel trade flows.”

Competitive Pricing and Offtake Trends

Vipul Garg, Senior Pricing Reporter, Energy Transition, S&P Global Commodity Insights, observed: “Recent Indian tenders have achieved hydrogen prices below $4/kg and renewable ammonia near $600/mt, very competitive by global standards. While questions remain about long-term sustainability of these prices, binding offtake agreements with refineries and fertilizer producers signal strong initial demand. With expanding interest from steel, transport, and other hard-to-abate sectors, incentives and carbon credits could further bridge the cost gap with fossil fuels.”